Table of Content

If you need to find out extra about our nanny payroll and pension providers, please get in touch with us. Wave Payroll offers reside chat Monday by way of Friday and e mail assist in your customer service wants. Merchant Maverick’s rankings are editorial in nature, and aren't aggregated from person evaluations. Each workers reviewer at Merchant Maverick is a topic expert with experience researching, testing, and evaluating small enterprise software and providers. The score of this firm or service relies on the author’s skilled opinion and analysis of the product, and assessed and seconded by one other subject matter skilled on workers before publication. Merchant Maverick’s rankings aren't influenced by affiliate partnerships.

For instance, in case your nanny makes $15 per hour and worked a complete of 162.5 hours for the month, multiplying these numbers collectively offers you $2,437.50 — the nanny’s gross month-to-month wages. Your employee doesn’t need to contribute, and you won’t withhold anything toward it from their pay. The FUTA tax rate can drop to just zero.6% as a outcome of you can declare a 5.4% credit score if you should also pay state unemployment taxes.

Poppins Payroll

When you first employ a nanny, you may at first be confused about the strategy of paying them legally, and if you referred to as for a quote from a nanny payroll service, you'll in all probability be surprised at the value. But you have numerous selections to deal with payroll, and they differ in numerous methods, corresponding to payment means, time investment, value of service, etc. Let’s consider the nanny payroll alternate options in a bit more element. Pay My Nanny provides friendly, accurate and dedicated payroll providers to nanny employers, with prices ranging from as little as £140 a 12 months. Your nanny may request you to withhold federal earnings taxes. If you comply with this and have a W-4 completed by the nanny, you could proceed to withhold these taxes.

Your nanny tax payroll is in good arms and we have no hidden charges unlike most competitors. Independent contractors are responsible for paying their own Medicare and Social Security taxes—the elements of employment taxes—in the type of the self-employment tax. These taxes can price you about 10% over and above what you’ve agreed to pay for providers. A totally different arrangement for childcare or for maintaining a clear home might spare you this further expense. Nannies are paid an hourly wage in cash or by verify on a day by day, weekly, bi-weekly, or month-to-month foundation. Some employers of nannies additionally decide to make use of money transaction apps to pay their nannies.

Steps To Create A Caregiver Or Nanny Payroll Account

The company's FAQ section is stuffed with widespread questions and clear solutions about nanny tax laws, contracts, and overtime, and its nanny payroll guide is extremely comprehensive, to say the least. You also can obtain a sample nanny contract for free from the location to use as a jumping-off level. HomePay calls this “concierge assist,” and it means you get limitless cellphone, chat, and e-mail help, technical and onboarding help on your employee, and audit assistance, if essential. The flat monthly price for Savvy Nanny is $40 and there could be a $50 annual charge.

Employers' Liability Insurance is an important legal requirement to satisfy the Employers' Liability Act 1969. Some payroll bureaus will try and promote you this insurance coverage without supplying you with the correct guidance on other options obtainable to you. NannyPaye recommends firstly checking your present house insurance coverage policy as this can normally present the legal minimal insurance cowl you require.

Wondering How Much Must You Pay A Nanny?

Prepare children's meals, clear up after the kids, do a variety of the family's buying, and carry out light housekeeping. You solely need to pay into Social Security on up to $147,000 in your employee's wages in 2022 and up to $160,200 in 2023. Earnings over these quantities are exempt from Social Security, though there’s no similar rule or limit for Medicare.

Find out every thing you should know earlier than you chop your first paycheck with The Ultimate Payroll Taxes Guide For Small Businesses. You might need to present info to the IRS together with your authorized structure , your authorized name, Social Security Number, and address. Once your application is submitted and accredited, you have the choice to obtain your EIN online instantly. Your portion of FICA taxes, together with the amounts you withheld from your employee’s earnings, must be paid together with some other tax you would possibly personally owe when you file your individual Form 1040. Prepare a Form W-2 for your worker for the previous year’s wages and give them Copies B, C, and a couple of by Jan. 31 of the following tax year. You must prepare a separate Form W-2 for each household employee if you have multiple.

We suggest the most effective products via an unbiased review course of, and advertisers do not affect our picks. We might receive compensation if you visit companions we suggest. Our unbiased evaluations and content material are supported partly by affiliate partnerships, and we adhere to strict pointers to protect editorial integrity. The editorial content on this page is not supplied by any of the businesses talked about and has not been reviewed, approved or in any other case endorsed by any of these entities. Help us to improve by offering some suggestions on your experience right now. Let us know the way properly the content on this page solved your downside right now.

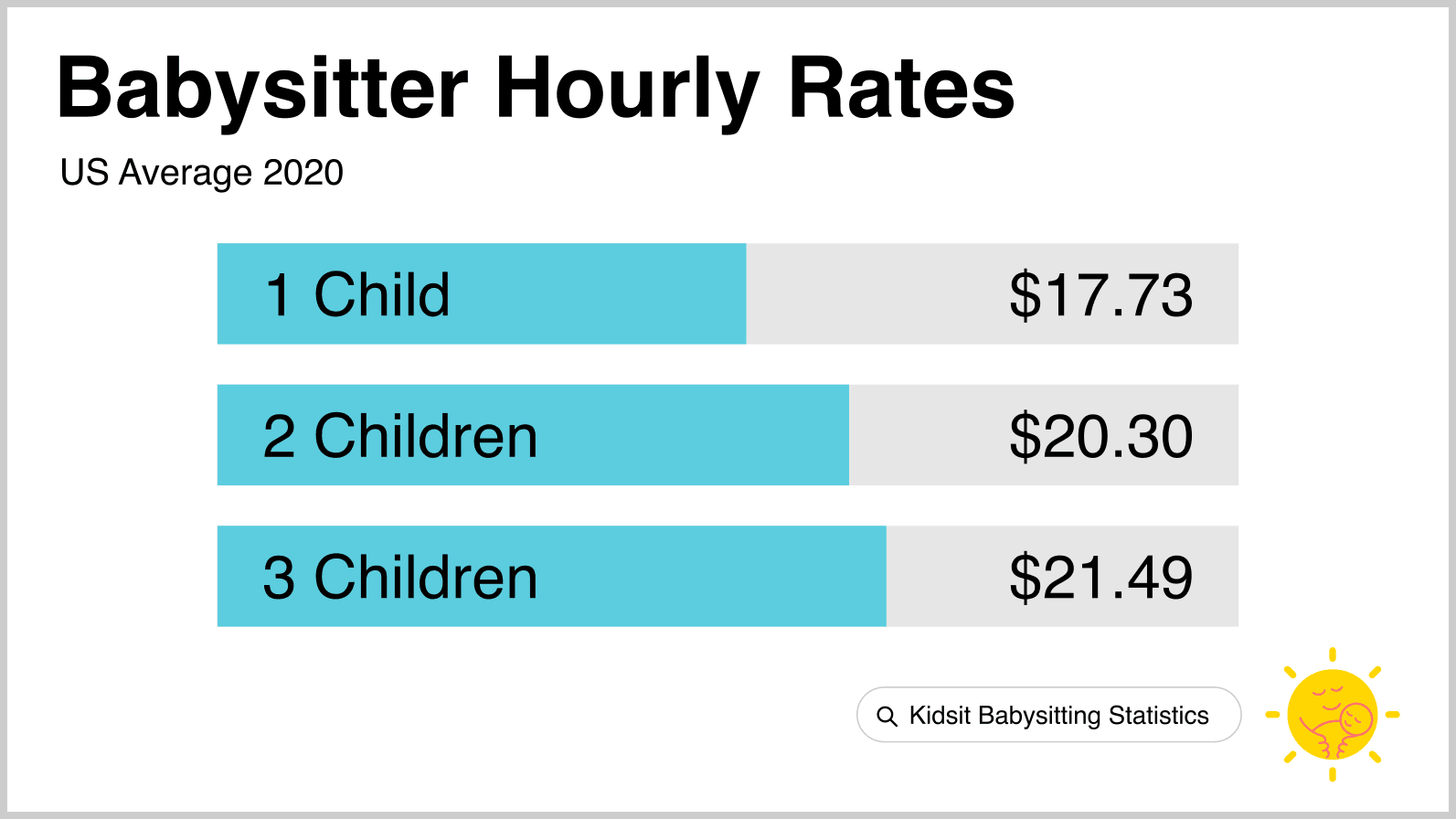

You should have an adjusted gross revenue of $438,000 or much less to be eligible for the credit score. WORKER’S COMPENSATION AND DISABILITY INSURANCE A nanny who works forty or more hours per week for the same employer have to be coated by workers’ compensation insurance coverage and incapacity benefits. UNEMPLOYMENT ELIGIBILITY Workers paid on AND off the books are eligible to file for unemployment advantages even if they have not paid taxes on their revenue. Employers pay their nannies the variety of hours they put aside in their schedule to work - even if an employer comes home early or has other caretakers (e.g., grandparents). How many kids your nanny will look after.Nannies that watch multiple children ought to earn more than nannies watching one youngster.

Step #6: Withhold Federal & State Taxes

You can add additional family employees for $6 per worker per thirty days. The company may be very clear and lists all attainable bills in a pop-up kind. The extra charges all stem from attainable errors like non-sufficient funds or re-running payrolls. It is possible to pay your nanny via Venmo, and there are even payroll software choices that permit you to do this simply.

We seemed on the numerous plan pricing and costs to pick the best nanny payroll companies, as these differ significantly amongst suppliers. Then we reviewed features of self-service and full-service plans, together with distinctive choices like help with new-hire paperwork or signing up for an EIN. Lastly, we evaluated providers primarily based on features useful to families and workers, like mobile functions, PTO tracking, and annual tax form documents.

One last item to note is that you simply also wants to make certain to check your state laws regarding frequency of pay to ensure you’re following labor laws in your area. You cannot declare a nanny in your taxes, but you might be eligible for the kid and dependent care tax credit score. To declare the credit score, the qualifying youngster have to be under age 13, and the nanny have to be taking care of them since you're working or on the lookout for work.

No comments:

Post a Comment